These $0 annual fee cards are best for those who are new to credit cards, have low credit scores, travel infrequently, or want to supplement a higher-end card from the same issuer.

Chase Freedom Flex (referral link)

pros: easiest way to accumulate points with day-to-day spending, extra perks like DoorDash and Instacart

earn 20,000 points after spending $500 in the first 3 months, 5x points on quarterly bonus categories like groceries or gas, 3x points on dining, 3 months of DoorDash DashPass, and 3 months of Instacart+

cons: no transfer partners, has foreign transaction fees

pros: good signup bonus, no foreign transaction fees

earn 20,000 bonus miles after spending $500 in the first 3 months and 1.25x miles on every transaction.

cons: not great for earning points after signup

pros: good signup bonus, travel transfer partners

earn 20,000 points after spending $1500 in the first 3 months; earn 2x points on gas and grocery, 1x on everything else

cons: hard to earn points, low points value

pros: good signup bonus, easy to earn points, no foreign transaction fees

earn 20,000 points after spending $1000 in the first 3 months, 4x points on dining, and 2x points on streaming, groceries, and gas

cons: no transfer partners

pros: the only card that lets you earn points on rent, great transfer partners (including Hyatt), no foreign transaction fees

earn 1x points on rent, 2x on travel, 3x on dining, and double points on the 1st of each month

cons: no signup bonus, doesn’t support Zelle for rent payments

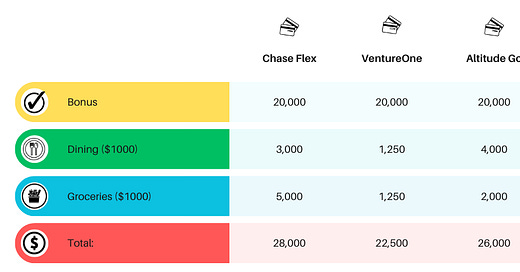

Points Projection Chart

Verdict

You really can’t go wrong with a no-fee card. However, there are better Capital One rewards cards available, and I’d recommend splurging on one of those instead of the VentureOne since it’s difficult to earn points.

The Citi Rewards+ cards offer solid sign-up bonuses and have good transfer partners like Flying Blue and Virgin Atlantic. However, earning points isn’t as easy as other cards, and the value of those points isn’t as good as Chase, Capital One, or Bilt. Overall, not bad for a no-annual fee card, but not the best way to maximize benefits.

The Freedom Flex is an amazing supplement to the Chase Sapphire Preferred (which I’ll discuss in the next post), and I’ve earned 60,000 points in the first 6 months alone. On its own, the appeal lessens since you can’t transfer your points to travel partners, and you can’t use the card internationally without paying foreign transaction fees. If you get this one, use it to rack up Chase points and eventually pool them with the Sapphire card.

The US Bank cards are quickly gaining momentum in the travel rewards realm, but I haven’t personally tried them so I can’t vouch for the travel portal or point redemption rates. Still, the Altitude Go seems like a solid starter card.

I dream of the Bilt Mastercard since their point system is highly rated (on par with Chase), and they have coveted transfer partners like Flying Blue, United, and Hyatt. Unfortunately, I pay rent with Zelle, which they don’t accept. If you pay rent via check, Paypal, Venmo, or an online portal—jump on this one!

**Come back next week to learn about the mid-range cards…