These cards are best for the experienced traveler with a good credit score and those who want to maximize points without paying a premium

All cards: $95 annual fee, no foreign transaction fees, travel protection benefits

Chase Sapphire Preferred (referral link)

pros: annual $50 hotel credit, free DoorDash DashPass, excellent transfer partners, annual 10% points bonus

earn 60,000 points after spending $4000 in the first 3 months, 5x on Lyft, 2x on travel, and 3x on dining

cons: no TSA PreCheck or Global Entry benefit

tip: maximize points by pairing with the $0 annual fee Freedom Flex. The Flex has no transfer partners on its own, but you can transfer points from your Flex to your Sapphire Preferred and then onto hotels and airlines.

Capital One Venture Rewards (referral link)

pros: free TSA PreCheck or Global Entry, $50 hotel experience credit in their portal (spa, dining, etc.), high signup bonus

earn 75,000 points after spending $4000 in the first 3 months and 2x points on every purchase

cons: no bonus spending categories

pros: $100 off a $500 hotel stay (booked through Citi portal), high signup bonus

earn 70,000 points after spending $4000 in the first 3 months, 3x on travel, dining, gas, and groceries, 1x on everything else

cons: no bonus perks like TSA PreCheck or DashPass, $100 hotel credit isn’t easy to capitalize on

pros: $0 annual fee for the first year, 4 free lounge visits each year, free TSA PreCheck or Global Entry

earn 50,000 points after spending $2000 in the first 4 months, 4x on travel and the first $1000 each quarter, 2x on dining and groceries

cons: no transfer partners

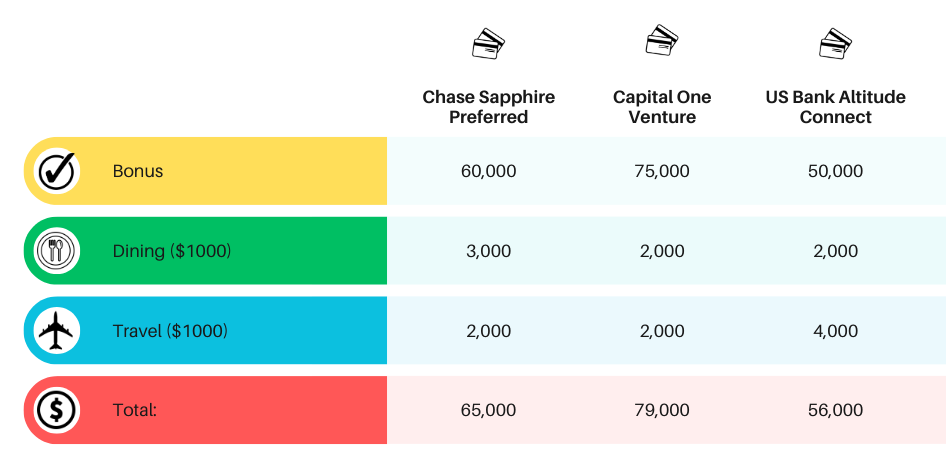

Points Projection Chart

Verdict

The Chase Sapphire Preferred is considered the most well-rounded travel rewards card and should be in everyone’s wallet. The $50 hotel credit erases half of the annual fee, and the points are highly valued. Pair that with excellent travel protection like rental car insurance, trip cancellation insurance, baggage delay insurance, and purchase protection (which covers damage or theft on purchases within first 4 months), and you can’t go wrong. If you’re a big spender or prefer luxury rewards, you might want to hold out for the Sapphire Reserve.

While the Capital One Venture card racked up the most points on the table, there are no bonus spending categories, and points aren’t worth as much as Chase’s. Still, the card is a good value since free TSA PreCheck and a hotel experience credit help cancel out the annual fee. Pick the Sapphire Preferred over this one, or get them both (like I did).

I am not part of the Citi Rewards ecosystem because I believe there are better alternatives available. And, this card doesn’t offer additional perks other than the hotel discount, which isn’t the best deal. However, the high signup bonus and 3x spending categories definitely catch my eye. I’d still go with the Chase Sapphire simply because there are more transfer partners, but the Citi Strata Premier wouldn’t be a bad card overall.

With a $0 annual fee for the first year and 4 free lounge passes, the Altitude Connect is an enticing entry. The bonus spending categories (especially 4x on the first $1000 spent each quarter) make it easy to earn points. Unfortunately, the lack of transfer partners devalues the card’s rewards.

*Next week, I’ll discuss luxury cards…